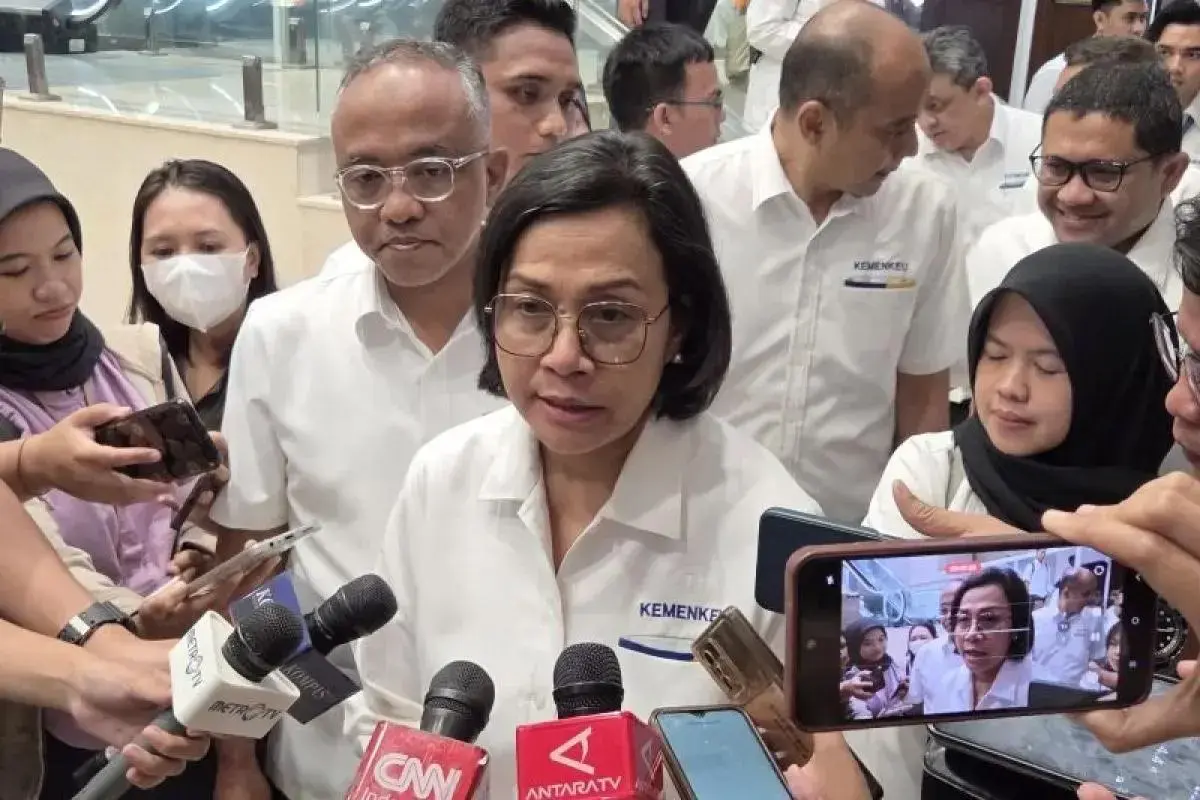

Inp.polri.go.id - Jakarta. Minister of Finance Sri Mulyani Indrawati has issued a new regulation requiring e-commerce platforms to collect income tax PPh 22 from sellers with annual turnover above Rp 500 million.

The regulation was signed on 11 July 2025 and came into effect on Monday (14/7/2025).

Designated marketplaces, as Electronic System Trade Organizers, are now responsible for collecting a 0.5% tax on sellers' gross annual turnover, excluding VAT and luxury tax. Sellers must submit a declaration letter once their turnover exceeds the threshold, according to antaranews.com.

Sellers earning below Rp 500 million annually are exempt upon submitting a self-declaration. Exemptions also apply to ride-hailing delivery partners, sellers with tax exemption letters, and transactions involving gold, gemstones, prepaid phone credit, or land/building rights.

(mg/inp/pr/rs)