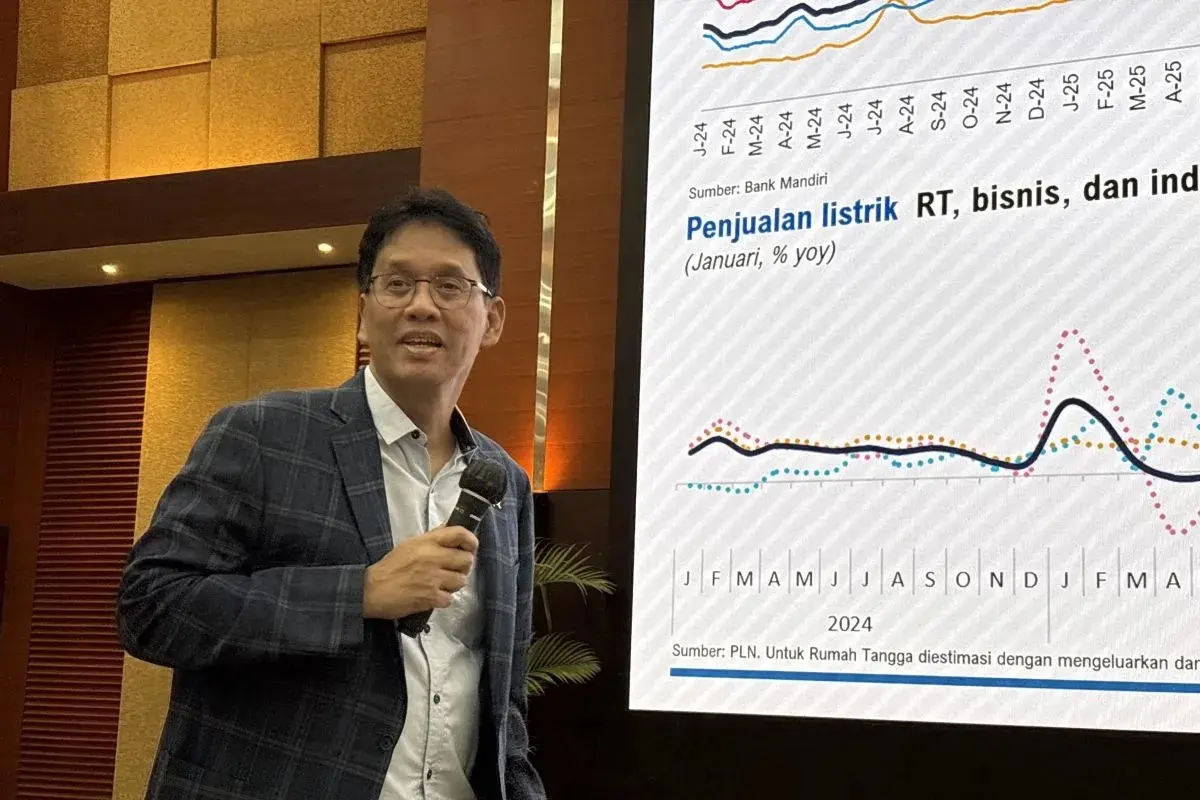

Inp.polri.go.id - Jakarta. Bank Indonesia (BI) has increased the intensity of its market interventions to stabilize the Rupiah amid heightened global financial uncertainty.

Governor Perry Warjiyo announced Wednesday (21/1/2026) that the central bank is actively engaging in the spot market and both onshore and offshore non-delivery forward (NDF) markets to curb excessive volatility.

"This policy response ensures exchange rate stability remains consistent with our 2026 inflation target of 2.5% plus or minus 1%," he said during a virtual press conference, as reported by antaranews.com

The Rupiah was recorded at Rp16,945 per US dollar on Tuesday, marking a 1.53% depreciation since late 2025. This decline is attributed to foreign capital outflows and rising domestic corporate demand for foreign exchange.

Despite current pressures, BI maintains a positive outlook, banking on attractive yields, low inflation, and robust economic growth to drive a future recovery. The central bank also plans to strengthen its pro-market monetary operations to maintain long-term financial resilience.

(mg/inp/pr/rs)