DPR Approves Thomas Djiwandono as New Bank Indonesia Deputy Governor

Commission XI DPR RI approves Thomas Djiwandono as Bank Indonesia Deputy Governor. Read about the strategic monetary-fiscal synergy plan for 2026.

Commission XI DPR RI approves Thomas Djiwandono as Bank Indonesia Deputy Governor. Read about the strategic monetary-fiscal synergy plan for 2026.

Bank Indonesia intensifies market intervention to stabilize the Rupiah as it hits Rp16,945 per USD. Read the news for Governor Perry Warjiyo's full economic outlook.

Finance Minister Purbaya says a proposed role swap between the Finance Ministry and Bank Indonesia will not undermine BI’s independence. Read the full story.

Bank Indonesia projects stronger economic growth in Q4 2025, supported by consumption and investment. Read the full report.

Bank Indonesia reports Indonesia–Malaysia cross-border QRIS as highest in ASEAN. Read the latest update.

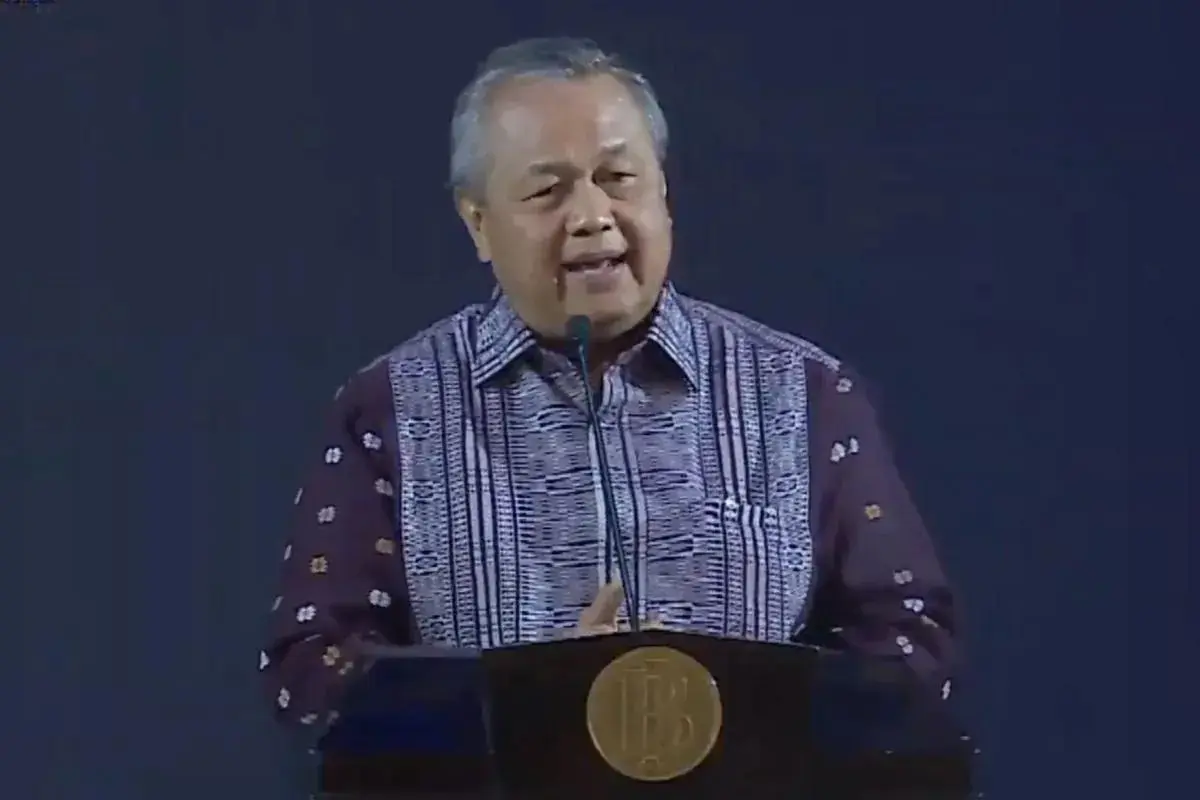

Bank Indonesia Governor Perry Warjiyo said the 2026 monetary stance will stay “pro-stability and pro-growth,” with BI preparing room for rate cuts, rupiah stabilization, and deeper financial markets. Learn more.

Bank Indonesia lowers BI-Rate to 4.75% to spur growth while ensuring rupiah stability and low inflation. Read the full update here.

Bank Indonesia targets QRIS use in China by late 2025 after sandbox trials with PBoC and UnionPay. Digital payments in Indonesia show strong growth. Read more.

Bank Indonesia rejects claims that Payment ID will monitor personal transactions, affirming full compliance with Indonesia’s data privacy laws. Read the full clarification here.

Bank Indonesia keeps benchmark interest rate steady at 5.5% while projecting stronger economic growth in the second half of 2025. Discover more about BI’s latest rate decision and how it plans to fuel growth.

Bank Indonesia showcases Indonesia’s resilient economy and investment potential at the Swiss-Indonesian Forum—explore key insights and projections driving investor confidence in 2025.

A 23-year-old Bank Indonesia employee died after jumping from the rooftop of the central bank's office complex in Central Jakarta on Monday morning. Learn more.