Inp.polri.go.id - Jakarta. Indonesia’s Financial Services Authority (OJK) reaffirmed that the nation’s banking sector remains solid and resilient, supported by controlled risk levels and stable liquidity, according to its Banking Surveillance Report (LSPI) for Q2 2025 released on Friday.

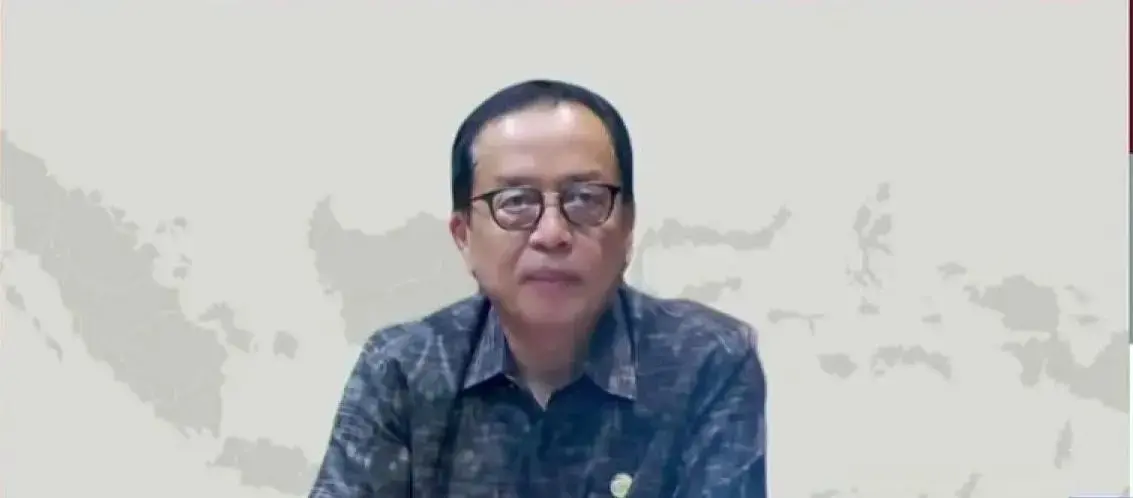

“The OJK continues to encourage banks to uphold prudential principles, professionalism, innovation, and integrity to achieve strong, healthy, and sustainable growth,” said Dian Ediana Rae,the OJK’s Chief Executive for Banking Supervision, as quoted by antaranews.com on Saturday (11/10/2025).

OJK reported positive intermediation performance with rising credit disbursement and strong third-party funds, which grew 8.51% year-on-year as of August 2025, surpassing credit growth of 7.56%. Asset quality improved, with gross NPL stable at 2.28%, while liquidity and capital adequacy remained robust with CAR stood at 26.03%.

OJK also highlighted the automotive industry’s growing global position, ranking among the world’s top 15 vehicle producers in 2024, driven by synergy between the government, financial institutions, and manufacturers.

(mg/inp/pr/rs)