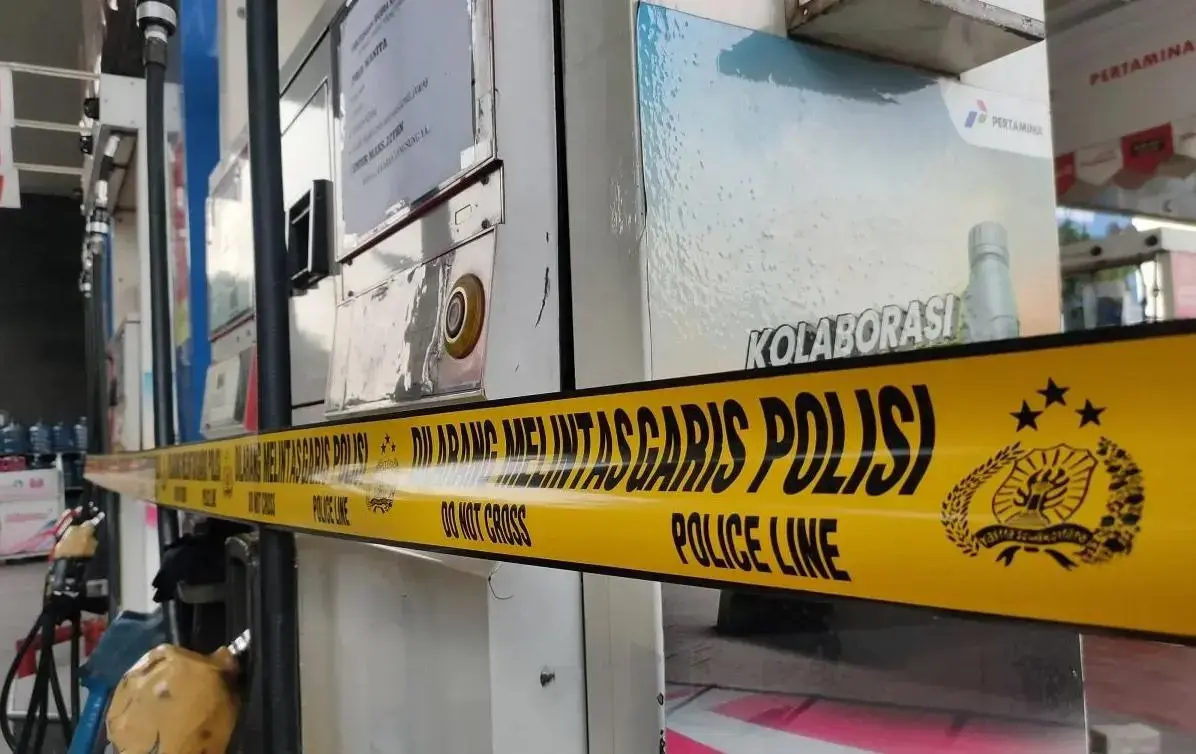

KPK Names Banjarmasin Tax Chief, Customs Chief as Suspects

The Corruption Eradication Commission (KPK) has named nine suspects in two separate sting operations targeting alleged corruption within Indonesia’s fiscal institutions. Read the latest investigation development.